Most everyone can point to some of the lingering effects of the Great Recession: shifts in consumer behaviors, the acceleration of disruptive technologies, heightened financial regulations, etc. But the recession had impact on something far less obvious, but no less critical – it radically changed how successful businesses plan. The extraordinary frequency and pace of change in the marketplace over the last ten years has made ordinary methods of planning and project management obsolete. And as 2018 rolls into hyperdrive, financial institutions are still discovering that no matter what type of planning you’re doing – marketing, sales, strategic, technology, product, etc. – you need a new, agile approach. Planning and preparing for a successful year ahead should be anchored in two simple concepts: focus and flexibility.

Focus

Sharp focus is critical to sustained success; and I have found these three steps are necessary in clarifying choices and achieving a single-minded approach to any initiative.

- Describe Where You Are

This is not as easy as it sounds – unless you are a data-driven organization. So many times, planning begins from a foundation of incorrect assumptions. A recent survey from KPMG[i] revealed that over half (56%) of CEOs are concerned about the integrity of the data they are using for decision-making; and over a third (36%) say they cannot make data-driven decisions until they invest significantly in data quality. Nevertheless, planning is most successful when every strategic decision is grounded in relevant data.

But for a variety of reasons (e.g. data silos, lack of talent, legacy systems, etc.), community banks and credit unions have struggled with harnessing the power of data – the data they can access (their own customer data) and data they can acquire (supplemental data on their customers or markets). But the effective use of data and analytics allows you to look at the truth of your current situation, as well as predict likely potential.

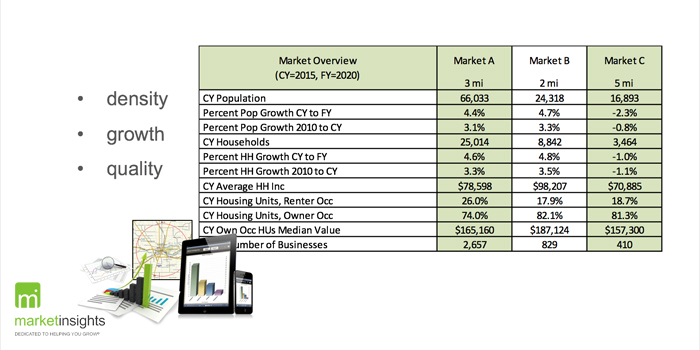

As an example, markets large and small are experiencing demographic changes. Shifts in variables such as age, ethnicity and employment status can drastically alter a market profile, and an institution’s prospects for ongoing profitability. Examining current demographic data helps you evaluate factors like market density/quality, challenge assumptions and know the predominant characteristics of your market. This is especially helpful when comparing specific trade areas within your branch footprint.

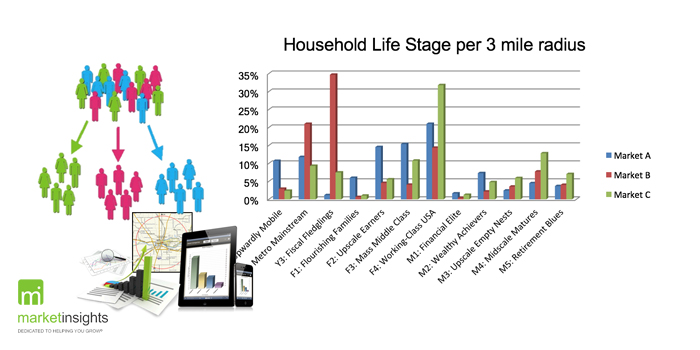

Similarly, psychographic and behavioral data provides essential insight into customer needs, attitudes, interests and channel preferences. It is important to remember that, like all data, psychographic data is not static. Approximately ten percent (10%) of market area households can shift from one segment to another each year.

Obviously, the type of data you examine depends on the plan you are trying to create. But the more accurate and up-to-date the data, the clearer your choices become.

- Define What You Must Achieve

You’ve probably heard the saying “A goal without a plan is just a wish.” It is just as unwise to have a plan without a goal. Gather your planning team together and get each to weigh in on what they hope to achieve with the plan. One manager I know asked her team, “If success was a place, how would we know if we got there?” Depending on the size of your team, you’re likely to get multiple ideas about what your plan needs to accomplish. Word of advice: limit your choices and reduce your timeframe.

When facilitating planning conversations, I will often ask “if your plan could achieve one thing, what would it be?” This type of extreme focus forces individuals to declare their top priority. This is especially helpful when a large group is involved in planning. But it also works on an individual basis. Imagine if your commercial banker had just one primary goal: to book two sales appointments, every day of the week, every week of the year. When he/she does that one single thing, your likelihood of sales increases which has a ripple effect on your entire organization.

And when in a larger group and multiple (and possibly competing) priorities have been offered, then the process of building consensus around a limited number of choices can begin. In most cases you should pick no more than three. Why three? Too many priorities often yield diminished results across the board. Think of the 80/20/80 rule. By placing 80% of your focus on a vital few activities (20%), you get your biggest effect (80% of your overall results).

Regarding time-frames, it is fine to have a long-term vision for what you want to accomplish. However, short- or medium-term time frames (of 12 to 36-months) help focus choices and can be every bit as strategic (as well as operational/tactical) as the typical 5-10-year plan.

- Determine Who Is Accountable

A final step in achieving focus is assigning accountability for the actions that are required to achieve the goals you’ve established. Without this step, you may not get to where you want to go. Selecting a champion for each element of your plan helps ensure that a chosen priority receives the time and resources essential for success.

Flexibility

Competitive advantage doesn’t happen because of how you plan – but the flexibility with which you implement and execute. The world of financial services is changing faster than ever and frequently veers off of a predictable course. Here are three more steps that will help you build flexibility into your plan.

- Review Your Plan Regularly

Planning is never a one-time event. It is a process. Monthly meetings to monitor and evaluate the plan, among those who created it, will help you identify when/if your initial assumptions are off track and revision is required. Keeping an eye on the data points that informed creation of your plan is key. In other words, set up a structure to collect, review and discuss information as you implement your plan.

- Adjust Your System of Budgeting

Just as routine monitoring of your plan is important, flexibility requires a dynamic system of budgeting. Dynamic budgeting gives you the ability to make changes based on incoming data so you can redirect resources as necessary. Depending on the nature of your plan, your CFO may even be able to set up triggers that will make flexible budgeting decisions less problematic.

- Support Your Culture’s Agility

Agility within business refers to an institution’s ability to promote operational and individual flexibility so it may adapt rapidly to internal and external changes. Adaptability should be one of your organization’s core values. Joe Cooper, Vice President, Financial Services Sector at IBM has been quoted saying “The ability to be agile – to sense, decide, and act quickly – will replace strategy as the key driver of organizational success. Your plan will have the greatest chance of success if your people are capable of letting go of old ways and learning new processes, procedures and technologies.

Focus helps unite individuals within teams, teams across departments and departments across organizations. Flexibility helps you adapt when customer or market assumptions are no longer valid. This approach to planning has worked for many of our clients in recent years. No matter how you plan for 2018 and beyond, remember the wise words of Henry Ford: “Whether you think you can, or you think you can’t – you’re right.”

[i] https://home.kpmg.com/xx/en/home/insights/2017/08/trusted-analytics-matter-to-ceos.html